Hello hello! Now that we’re more than halfway through March, it’s time for us to go through our February money recap.

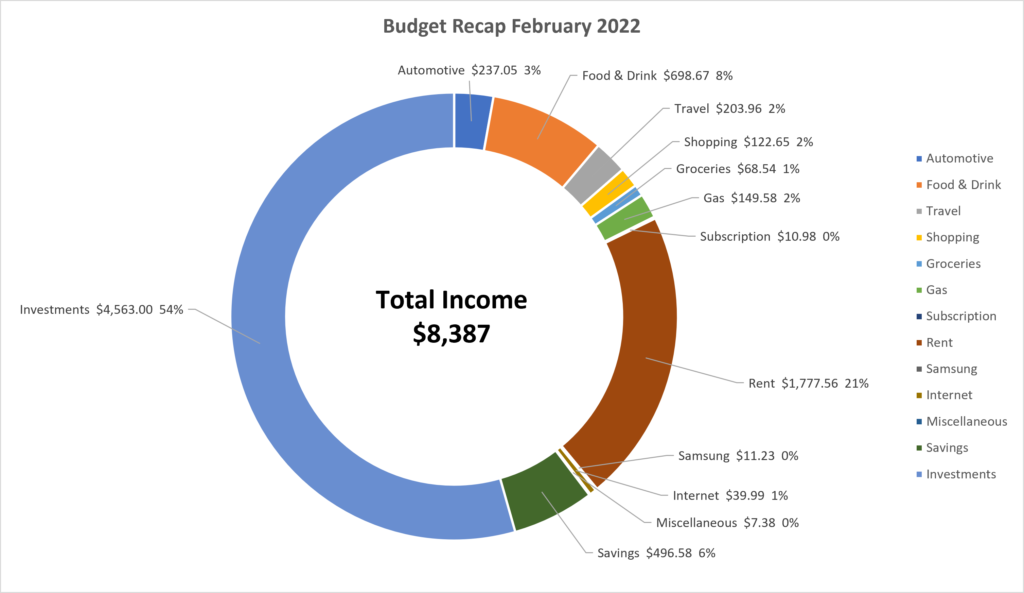

In summary, the GF and I save/invest $5,996.58 for February 2022. This is about 71% of our combined income. This breaks down to about 6% in savings and 65% in investments.

As always, the allocation of savings and investments will fluctuate as my GF invests irregularly, and I try to invest more when the market dips! For example, my GF did transfer $937 from her savings and invest that money, so you’ll see that our total number for this month exceeds our income because I included this additional amount. If we exclude the additional investment, then our total saving/investment this month is 60% of our income.

Our expenses are 40% of our income for this month. The highest expense we have is rent and utilities, which is 21%.

Our food is about 9% of our income. This is a large decrease from 16% last month because the GF had her wisdom teeth removed, so she was out of commission for a while. But this is still our second-largest expense after rent.

The rest of our expenses is 9% of our income. This includes travel, shopping, gas, internet, our Samsung tablet payment, subscriptions, and automotive-related expenses (oil change and a towing fee 🙁 ).

Aside from all of this, we also spent a reimbursable amount of $2,188.51 for the GF’s business trip for this month. This includes the cost for her flight, hotel, plane wifi, airport parking, and tolls. But since we’ll be reimbursed for this, I did not include it in our total spending. We did use my Chase travel card to pay for this, so we were able to rack up some additional travel points!

Overall, I think this calls for another good month! We saved/invested a large portion of our income and managed to keep our expenses mostly at the same level. Not only that, the market’s been in the red, so we were able to increase our yearly dividends on discounts!