One of our goals for 2022 is to stay on top of our spending, and to do that, we thought that it would be helpful for us to start sharing our monthly spending recap. This will help us see where our money is going each month and we also want to provide insight into what a monthly budget would be like for a Gen Z couple.

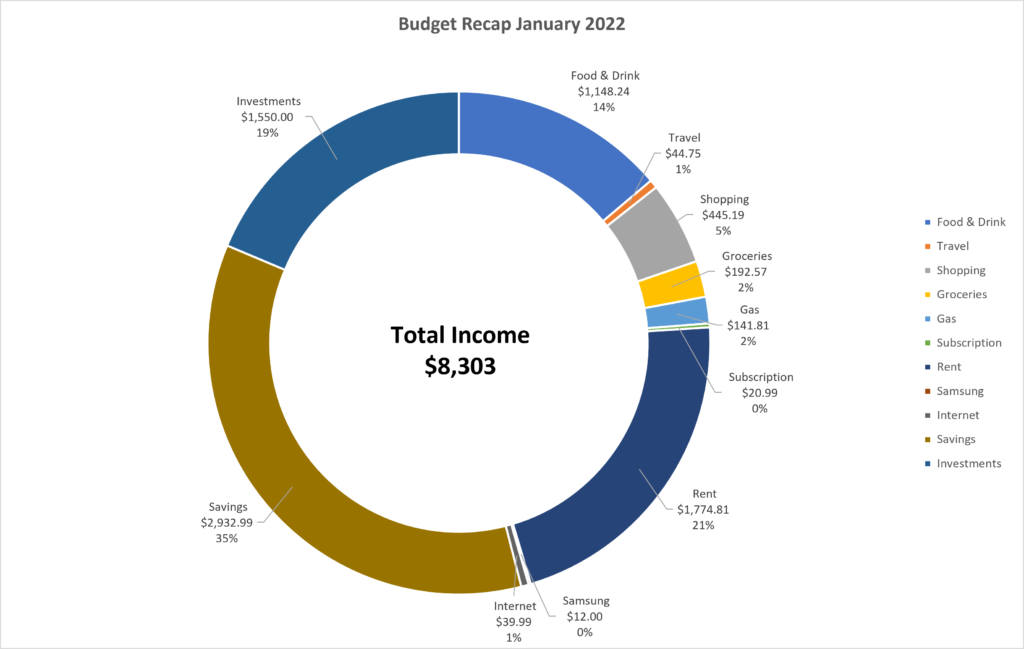

In summary, the GF and I managed to save/invest 54% of our combined income for the month of January 2022. This breaks down to about 35% in savings and 19% in investments. The allocation of savings and investments will fluctuate month-to-month as my GF invests irregularly.

Our expenses are 46% of our income for this month. The highest expense we have is our rent, which is 21%. While it is still under the normal 30% rule for housing, it is still pretty high for us. And to make matters worse, our rent will be higher starting in March with the new lease 🙁

Our food is about 16% of our income. This includes eating out, groceries, and boba 🙂 This will be where we spend the most out of all our expenses (except rent) since we really like food. And overall, we are happy with this. It snowed almost every weekend in January, so we did not get to go out to new restaurants as usual 🙁

The rest of our expenses are all minimal compared to our food/rent spending. This totals about 8% of our income, and it includes travel, shopping, gas, internet, Samsung (our payment plan for our galaxy tablet), and subscriptions. Gas has gotten exponentially more expensive in the past month, so our 5-hours-trip home to NC has gotten more expensive as well.

For travel, my GF went to Florida with her friend for a weekend! She was a plus one for a business conference. She used her Chase reward points for the free round-trip to Florida, the hotel was paid for by the friend’s company, and she joined the company for the weekend dinners and galas. So the only expense she had to pay on her travel was for her daytime meals and some coffees! What a steal!

Another travel “expense” we had in January was my mom flying up for a quick visit. I also used my Chase reward points to book her a flight up to DC! So for the month of January, by using our credit card points, we were able to book 2 roundtrip flights, valued at around $300, for FREE!

Overall, we are happy with our spending for January 2022. I think that we can invest a bit more and save a bit less, given that inflation is high, and we want as much of our money to work for us as possible in the stock market.