When it comes to budgeting, it could be intimidating when you first start out, but it’s nothing a little bit of math, dedication, and Youtube videos could not fix 🙂 We’ll walk you through how we build our budget, and hopefully, by the end of this post, you’d be able to do the same!

We broke down the general idea of budgeting and included our personal starter’s journey for reference!

Budgeting 101 in 3 Steps

1. Define your Needs, Wants, and Savings

The general rule of thumb when you first start to budget/save is to break it down into 3 categories: Needs, Wants, and Savings

- Needs = absolute necessities in your life that you will die without, e.g. rent, utilities, car payment/gas, groceries, etc.

- Savings = putting aside money for the betterment of your future, e.g investments, debt repayment, 401k, emergency funds, ROTH IRA.

- Wants = Flexible things that would be nice to have and can add value to your life but you do not necessarily need it e.g. eating out, shopping, subscription services, fitness memberships, travel, entertainment.

2. Prioritize your needs and savings

Needs and Savings should always come first.

Regardless of your salary, you should always budget for rent and allocate an appropriate amount to pay off any credit card debts and loan repayments you may have. You can then spend whatever is left at the end of the budget on your wants.

3. Pick a hobby/interest you want to focus on

Pick an interest or hobby you want to prioritize in your Wants category so you can better allocate funds for it! If food isn’t something you are keen on, then you can also set a grocery budget under the Needs category and allocate your Wants budget for other things like traveling or purchasing collectibles!

It’s all about prioritizing and optimizing your budget and lifestyle, so you get to do what makes you happy <3

How we budgeted after graduation with a salary:

When we first started, we went with the 40-30-30 beginner’s route. 40% for needs and necessities, 30% for savings, and 30% for wants. You can divide the ratio up to match your needs and the living standard in your city! We knew rent was going to be high and we knew that we wanted to save a lot, so we decided to split it into a simple ratio to experiment in the first year of adulting!

We started off with only the BF’s income of $70,000, or roughly $53,000 a year after taxes. According to the ratio we have set, our budget was the following:

Needs: $21,200/year or $1,700/month

Based on this budget, our rent should not be higher than $1,700/month. We had a couple of months to look for an apartment since it was our Senior Spring semester of college, and also there was no rush for us to get anywhere because it was the beginning of COVID. Fortunately, we were able to locate a place that is pretty close to everything, except that it was not within walking distance to a Metro station, since that would upcharge our rent by $300-500/month.

So in 2020, our rent + utilities came to around $1800 x12 = $21,600/year, which was not too much over our budget, and it was a reasonable amount that we can flex around with our monthly expenses.

Savings: $16,000/year or $1,300/month

The BF starts contributing to his retirement accounts (401k at his job and Roth IRA) as well as contributing to his taxable account.

His company does have 401k matching, through which they match his 401k contribution up to 6% of his annual salary. What this means is that for every dollar that he contributes to his 401k, his company will put in the same amount to his 401k up to 6% of his salary.

The BF contributes $6000 a year to his Roth IRA, which is the total you can contribute annually to your IRA account (note that this may change year over year).

After that, the BF put in whatever is left to his taxable account. A taxable account (or brokerage account) is a normal account, in which he can invest his money but without any tax-advantage characteristics. He can withdraw his money anytime he likes, but he would have to pay taxes on his gains (how much he has to pay in taxes depends on how long he’s held his investment for, more on this would be explored in later posts!)

Wants: $16,000/year or $1,300/month

Due to the crazy high rent, we weren’t able to include gas and car maintenance under the Needs category, so we just combined them under our Wants expenses and paid off any charges we put under our credit cards.

Wants is the FUN category. We decided that splurging on food would be our priority in our want categories. In 2020, we racked up between $800-1,000 in credit card spending for everything, but mainly dining and eating out 🙂 (We’ll make another post about credit card churning like cash back rewards and travel points)

That was our budget for the first couple of months after graduation while I was on the job hunt. And after I got a job, we decided to keep our budget the same, with me contributing to paying half the rent and keeping the rest in savings. So savings and rent remain our top priorities.

How to start budgeting if you have been working and paying bills:

The same rule of thumb from above applies here. You are going to start off by categorizing all of your expenses under Needs, Wants, and Savings (including debt/loan repayment). This way, you can figure out exactly where your money is going, and you can use this to work out a golden ratio for budgeting that will work for you. This part is going to take the most time since you are setting an understanding/foundation for your personal finance.

Tips: You can download annual spending statements from your Banks’ website/app, and most of the time, they already categorize your spendings into Grocery, Dining Out, Health Care, etc. You can also just go through your statements and organize them manually.

During this step, you can also think about what kind of financial goals (short-term and long-term) you are looking to pursue. For example, you could be trying to save for a big move, to buy a new laptop, to put more money into saving accounts, or to pay off a debt.

After you have figured out where your money went in the previous year, you can determine where you want your money to go this year!

If you have any outstanding credit card debts or loans, it is best to pay them off to prevent interest from accumulating. However, you can ignore your loans at the moment if it’s under something like the Student Loan Deferment 🙂

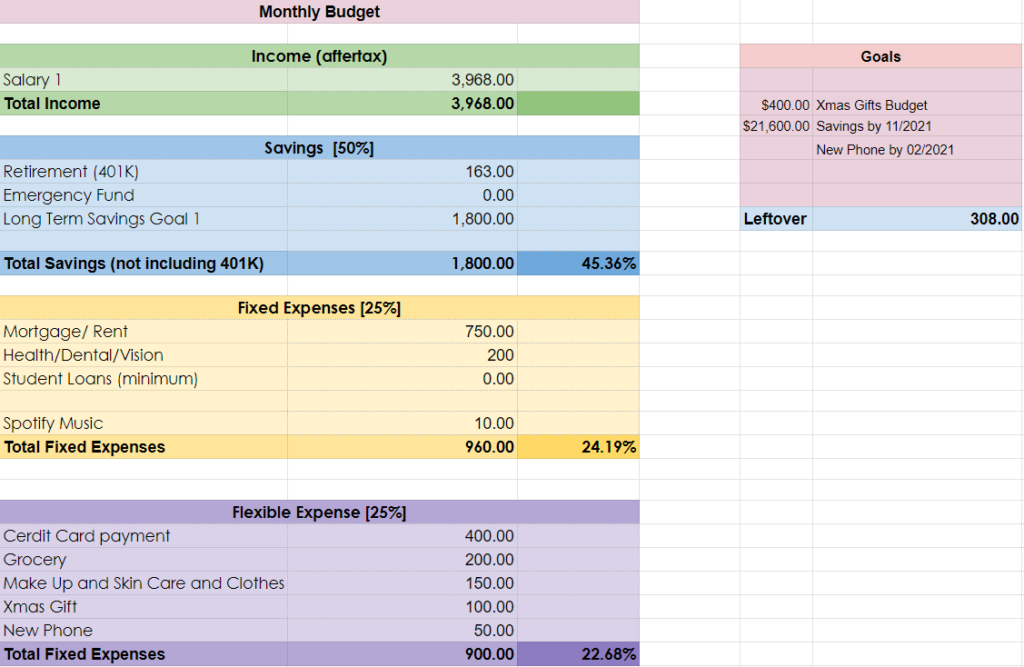

For a beginner’s guide to budget, I followed this excel spreadsheet layout from Bukola from Youtube!

Bukola’s spreadsheet is very simple and easy to use for someone who isn’t tech-savvy like me. It helped me visualize where my money could be going toward!

Asides from the expenses, I budget $150 each month toward beauty-related purchases such as clothes, make-up, and skincare. For a period of time, I budgeted $100 per month to save up for a new phone, and also $100 per month (for like 3 months) for Christmas gifts! Of course, all of these budgets fall under the Wants category.

By using a simple spreadsheet, I can clearly see where my money is going each month and how much I have left to spend. This is a great way to not feel overwhelmed with my spendings and feel guilty whenever I treat myself to something I want!

Even though this whole post sounds like we knew what we were doing with our personal finance for the first year of adulting, we did not know anything. All of the numbers above were just theories that we decided to try out after watching A LOT of FIRE and personal finance videos from Youtube.

2021 was our first full year of having full-time salaries and an expense record we could keep track of. We are happy to see those theories panned out nicely, and the world of personal finance is not as intimidating as it seems 🙂 We just needed a bit of time to understand it.