Over the past few months, we’ve been consolidating our portfolio to companies that we think have great business models, can grow their fundamentals, and ultimately will reward shareholders in capital gains and dividends.

An example of this would be Visa, one of the companies that we’ve started investing in in the last few months. We’ll go over its business model, how the company operates, and why we decided to invest in it.

Business Model

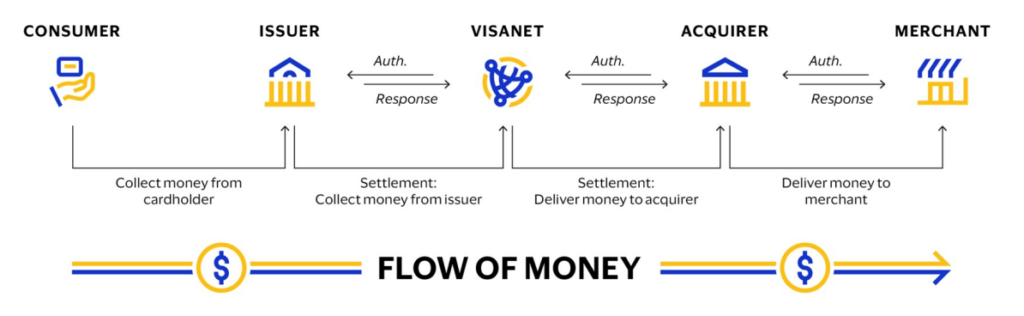

Visa is a company that enables payment solutions among consumers, issuing and acquiring banks, and merchants. This is called the four-party model, with Visa acting as the middleman.

In simpler terms, Visa acts as a “router” to route the payment between your bank (the issuing bank) and the merchant’s bank (the acquiring bank) without either party having to do anything work.

And Visa can do this through Visa-branded credit cards, debit cards, and prepaid cards.

For example, let’s say that you buy a cup of coffee, and you use your Visa-branded credit card to pay for it. When the coffee shop swiped/tapped your card, the acquiring bank (the bank that the coffee shop uses) would route the payment data through Visa network.

Visa then contacts the issuing bank (your bank) to check if you are authorized to make this purchase (this process is called authorization). The issuing bank would then check your account to see that there are no fraudulent activities and basically let the acquiring bank know that you are in fact authorized to pay for the coffee.

After all of this, the coffee shop would send the authorization to its bank to start the clearing process, through which the acquiring bank would ask for the money from the issuing bank. The issuing bank then send the payment to the acquiring bank, who then sends the payment, less merchant discount fee, to the coffee shop (this is called settlement).

To sum this up in a short and concise way, Visa helps facilitate the money transfer process between your bank and the merchant’s bank in a very fast and secure way whenever you use your Visa-brand card products. The same can also be said for Mastercard.

How Visa makes money

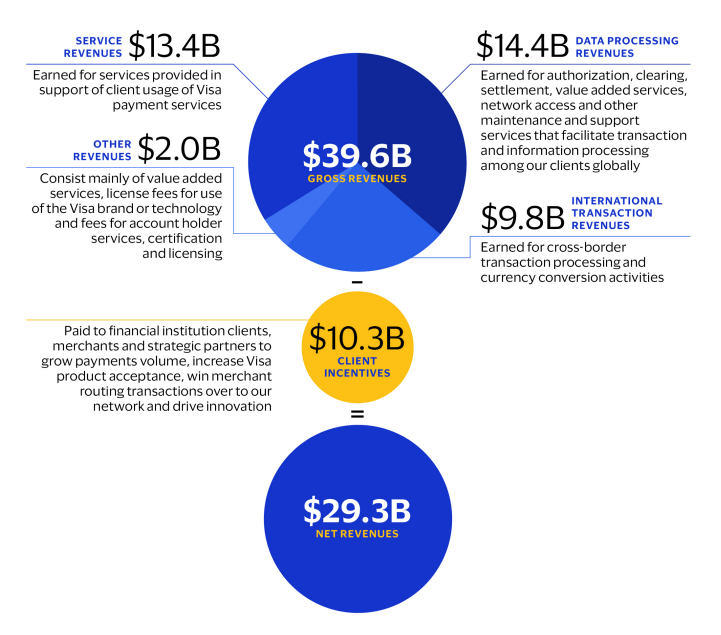

Visa makes money in multiple segments: service revenues, data processing revenues, international transaction revenues, and other revenues.

Service revenues: This consists of money collected from banks or other institutions that want to have access to Visa-branded products, and it is driven by the total payment volume. This means that the more expensive the product, the more Visa earns.

In 2022, Visa’s total payments volume was $11.6 trillion, and the service revenue was $13.4 billion. So, on average, for every $1 that you use to buy products, Visa keeps 0.12 cents as service fee.

Data processing revenues: This consists of money earned by doing the actual payment processing piece.

Whenever you use your Visa-branded card and go through the whole payment process, the acquiring bank pays the issuing bank a small fee called interchange fee. This fee is made up of mostly the merchant discount fee (what the coffee shop pays to be able to accept Visa-branded cards).

Out of that interchange fee, Visa gets a small portion of it. This revenue is mainly driven by the number of transactions processed.

In 2022, Visa processed 192.5 billion transactions, and the data processing revenue was $14.4 billion. On average, Visa earns 7.4 cents per transaction as data processing fee.

International transaction revenues: This is money earned via cross-border transactions and currency conversion activities.

In 2022, this segment earned Visa $9.8 billion in revenue, roughly 25% of gross revenue.

Other revenues: This is money made from other services provided by Visa as well as licensing fees. In 2022, this generated $2 billion for Visa.

Combining all of this, in 2022, Visa’s gross revenue was $39.6 billion. After subtracting $10.3 billion in client incentives (paid by Visa to the clients to grow payments volume and to increase Visa’s acceptance), Visa’s total net revenue is $29.3 billion. Minus the other revenues segment, this means Visa made roughly 14 cents per transaction.

How profitable is Visa?

Visa operates a very capital-light operation. It is a toll booth. Once set up, it takes little to maintain and generates lots of money.

In 2022, Visa generated $17.8 billion in free cash flow. This is a 61% margin based on its net revenue of $29.3 billion. Free cash flow is the amount left over after subtracting capital expenditure from the amount of cash generated by the operation.

And this is not unique for only 2022. Visa has been growing its revenue and free cash flow consistently. For the last 9 years, Visa grew revenue at an annual average rate of 10% and grew free cash flow at an annual average rate of 24%. This shows that Visa is more than capable of generating more revenue and retaining more money in profit each year.

In other words, Visa is very profitable. 🙂

What are the risks involved?

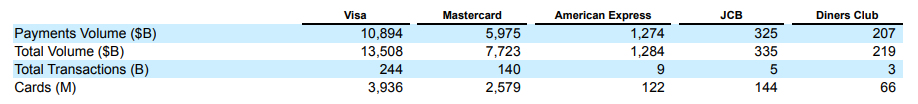

One of the risks is losing market share to competitors, such as Mastercard and American Express. As Mastercard acquires more issuing banks, it can issue cards that you use to pay for things, meaning that these payments will go through the Mastercard network instead of the Visa network.

Another risk is disruption from new fintech companies. An example would be Buy Now Pay Later (BNPL) companies like Affirm, Karna, etc. These companies work by letting you pay for things in installments straight from your bank account. This means that there is no payment routed through the Visa network.

There are also regulatory risks. Due to Visa and Mastercard being basically duopolies in the payment network field, there are concerns that they have too much leverage and power to dictate how much they can charge in fees. This could result in new regulations putting a cap on how much fees the payment networks can collect.

What about the competitive advantages?

Visa is one of the largest payment networks in the world by both total transactions processed and total volume. This gives them a lot of leverage when it comes to acquiring more issuers, and it creates a network effect. The more people use Visa cards, the more transactions Visa can process, ultimately leading to an increase in revenue.

It also has a built-in inflation hedge. As things become more expensive, Visa’s total volume can increase, which would also lead to Visa making more money.

Another big advantage for Visa is that it does not lend out money, meaning it doesn’t take on credit risks. This is a little bit different from American Express because American Express operates what’s called the closed-loop network, which basically means American Express issues its own cards and processes those cards on its network. By issuing its own cards, American Express takes on credit risks, and it negatively affects the company if the consumers decided to default on their cards.

Summary

Overall, Visa has one of the best business models out there. It takes little to maintain, generates tons of cash, does well during high inflation, and is hard to replicate (or at least not at the scale of Visa and Mastercard).

Visa also pays a dividend of 0.77%. This might seem small, but Visa has been growing the dividend at an annual rate of 18% for the last 9 years. That is an impressive growth rate.

We like to invest in companies like Visa because we think that it can continue to grow its business and pay out dividends to us in the long run. There is no evidence to suggest otherwise, yet.

And as always, this is not financial advice, so do your own research!