One of our adulting goals is to be able to purchase a single-family rental property in our 20s to give us exposure to the real estate market and also to generate some passive-active income on the side.

I did not have a specific type of real estate business model in mind, whether that be house-hacking, flipping, or just to have a permanent residence in our home state but sometimes use it for short-term rental and Airbnb.

However, as a college graduate in the early-Covid pandemic, and through 2 years of navigating through economic uncertainty and instability, the goal is quickly slipping out of our grasp.

When I was formulating my FIRE goals in early 2020, I decided to use the North Carolina real estate market as my homebase since that is what I am familiar with and grew up in.

In most markets outside of Charlotte and Raleigh, you can generally find a small single-family home between 800-1,500 sqft on the market for $80,000 – $120,000. That is generally the size and cost of my relatives’ homes back in early 2020.

Based on that and the standard 20% down payment for a property, I made the plan to save between $20,000 – $40,000 in my first 2 years out of college in order to make my first big adult purchase and investment.

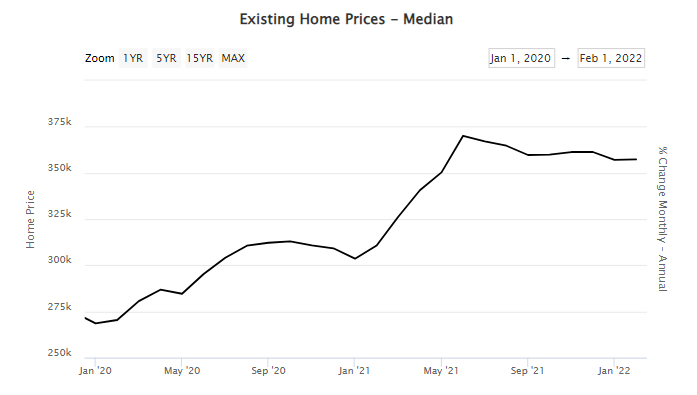

In the first year of the pandemic, the economy and real estate market shifted around between the home value and the interest rate, but nothing was too aggressive. That was until Spring 2021 when single-family homes were being sold for a minimum of $50,000 above the asking price!

Side Story: My aunt and uncle are flippers, and in Summer 2021, they made a bid of $60,000 over the asking price on a $40,000 property and lost.

Other Side Story: A friend of mine bought her first house in 2021 at $100,000 over the asking price, bringing the home value from $300,000 to $400,000.

On average since 2020, single-family homes have gone up 31% in the United States. Even though 31% is massive but arguably manageable, I have seen homes in North Carolina that have gone up over 100% in value.

For example, a relative of mine purchased a 2,000 sqft single-family home in Northeast Raleigh for $245,000. That same home is currently being valued at $445,000 on realtor.com and $410,000 on zillow.com. This is excluding the bidders who are offering $50,000 – $100,000 over the asking price on the market!

According to public records, the previous owner purchased the home for $162,000 back in 2002. The $83,000 increase in 17 years versus the $200,000 increase in 2 years is ridiculous, to say the least.

We cannot simply save fast enough to beat the inflation rates, including the mortgage rates going back up to their pre-Covid levels.

So how much does a Gen Z, or a Gen Z couple, need to save in order to purchase their first home?

The current average single-family home (3 bedrooms) in the Piedmont region of North Carolina is roughly $250,000. And at a 20% down payment, that is $50,000 in cash, excluding agents’ fees and other legal fees, and moving costs. With this guesstimate, it will be around $1,300 for the monthly mortgage. This is double what we were expecting to fork out for the purchase of the first rental property.

The average value for a single-family home (2-4 bedrooms house) in the DC is roughly $1,000,000, but for a 2-bedrooms condo in the area is roughly $400,000. And at the 20% down payment, that would be $80,000 in cash. Most condos in the city also have outrageous high HOA fees between $500 – $1,500 per month. This means that it will be between $2,500 – $3,000 in monthly costs including the HOA fee.

So to answer the question of this post, no, no we cannot afford to buy a house or condo in the current market.

It is a strong goal of mine to purchase my own rental property, but with the way the economy is looking, with inflation spiraling out of control, I might just look towards having all of my investments in stocks and generating passive income in dividends.