Dear readers,

Another chaotic year has passed us by. We’ve been busy coping with the current events and maintaining holistic balance in our day-to-day as lives must go on.

As the US dollar continues to lose its value and the market continues to be manipulated, we’ve reached the $500,000 milestone in combined investments and savings!

As of February 2nd, 2026, our portfolio is comprised of:

| Account | March 28th, 2024 | March 26th, 2025 | February 2nd, 2026 |

|---|---|---|---|

| HYSA | $27,455 | $38,727 | $39,977 |

| Regular Savings | $40,852 | $46,518 | $65,500 |

| Total Savings | $68,307 | $85,245 | $105,477 |

| Account | March 28th, 2024 | March 26th, 2025 | February 2nd, 2026 |

|---|---|---|---|

| BF Taxable | $66,106 | $88,116 | $138,927 |

| BF Roth IRA | $33,906 | $47,426 | $68,316 |

| BF Trad IRA | $11,383 | $13,008 | |

| BF Roth 401k | $7,882 | $18,681 | |

| BF HSA (excluded previously) | $9,879 | ||

| GF Taxable | $36,296 | $61,025 | $106,270 |

| GF Roth IRA | $9,287 | $17,819 | $30,275 |

| GF Trad IRA | $5,436 | $7,246 | |

| GF HSA (excluded previously) | $8,978 | ||

| Total Investments | $145,595 (sans Trad IRAs) | $239,090 (sans HSAs) | $401,580 |

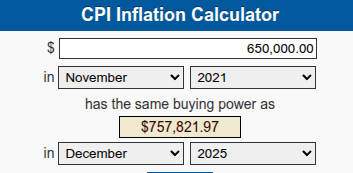

Once again, using the CPI calculator, the new inflation-adjusted FIRE goal has shifted up to $757,821.

As rough as that number is, we are blessed to have our jobs and a roof over our heads, allowing us to continue to contribute towards our FIRE goal.

The half-million mark is definitely a tremendous milestone! The fact that we increased our portfolio by roughly $200,000 within 1 year is a feat within itself (we forgot about the $400k mark). We are proud of what we’ve achieved!

As Type A individuals, there are so many things that we cannot control, so we are glad that we still have a grip on our finances. We’ve discussed what we would actually do when we reach our goal and are considering a sabbatical or a career break! We deserve a long break, free from financial, career, and socio-political burdens.