Now that we’re in 2024, it’s time to go over our finances and how much our investment changed in 2023. We’ll also go over our dividends amount, how much we received and how it compares to 2022. So let’s dive right into it!

Portfolio Overview

In January 2023, we started with around $75,000 across our investment accounts (Roth IRA and taxables) and $50,000 in savings, totaling to $125,000. At the end of 2023, the number goes to $128,000 for our investment accounts and $62,000 in savings. This totals to around $190,000!!

In 2023, we’ve contributed a total of $30,400 to our investments. This was smaller than what we had put in in 2022, which was $34,100, because we both changed jobs and went on a 1 month trip to Japan and Vietnam, so it strayed us from our path a little bit 😀 However, we’re aiming to put more of our money into investment this year!

As for our portfolio, it changed quite a bit throughout the year. At the start of the year, we had around 16 holdings, with the top 5 holdings being Starbucks, T Rowe Price, Blackrock, Taiwan Semiconductor Manufacturing Company, and Texas Instruments.

After we sold some of the positions (e.g. Crowdstrike, Home Depot, Lowes, etc.) and consolidated our investments, this came down to 11 holdings at the end of 2023, with the top 5 being SCHD, T Rowe Price, Visa, VICI Properties, and Taiwan Semiconductor Manufacturing Company.

The other companies in the portfolio are also high quality companies (e.g. Apple, Microsoft, Visa, etc.), and we are more comfortable holding these companies due to their strong business models, balance sheets, and we believe that they would be able to provide above market returns in the long run.

Dividend

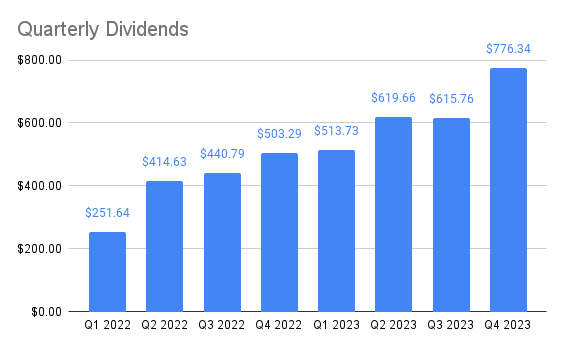

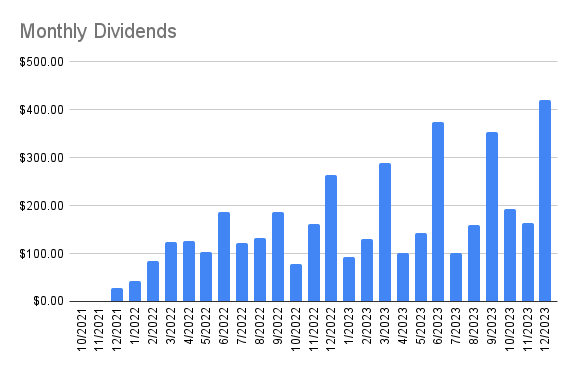

As for dividends, in 2023, we received $2,525.49, a 56.8% increase from 2022, which was $1,610.35. This is money returned to us for simply holding the stocks, without us doing anything (except for buying the stocks of course)!

As shown below, the dividend amount steadily increases each quarter, and that is one of the goals in our investment. Ideally, we’d want our dividend to increase quarter over quarter, either through buying more shares or companies increasing their dividend. Although the increase might seem small, overtime it will become a meaningful number!

This is a form of passive income that we’re building, and we expect this dividend amount to be even higher this year!

Performance

As for performance in 2023, our portfolio has a total return of around 23.6%, which is a little bit lower than the S&P500 total return of 26.3%. However, if we take into account of 2022, we re beating the S&P500 by around 5%!

It’s not as good as we had hoped, but we believe that our portfolio will do well in the long run!

What we learned in 2023 and Plan for 2024

If 2023 taught or reinforced anything, it is that the stock market is irrational and unpredictable. Compared to 2022, when the stock market seems to always go down month over month with no end in sight, 2023 was the opposite.

In fact, if anything, 2022 seems to be a great year to start your investing journey because everything was on a discount. This reinforces my view that you should always stay invested or you might miss the up cycle.

Our plan for 2024 is not that much different than previous years. We’ll still try to buy companies that are high in quality, that can continue to generate free cash flow and reward shareholders.

We’re comfortable with 11 holdings in our portfolio. While more diversification is good, we think that holding a handful of great companies is better than holding a lot of mediocre companies 🙂