We officially began our FIRE journey in June 2020 when we picked up our belongings and moved 300 miles up north to the Washington D.C. metro area. Even though it is rated to be one of the top 5 most expensive cities in the country to live in, we thought it would be the best fit for us considering my major in political science, and also for the bigger job market.

Fortunately, the BF was able to get a job offer prior to graduation. It made budgeting much easier having at least 1 solid source of income. The DC area does offer affordable housing/apartments for households making under a certain amount of income, so knowing that was reassuring.

The average monthly rent for a 1 bedroom / 1 bathroom unit in the area was around $2,100 at the time. However, we were able to rent our apartment for ~$1800 a month because it was in the early months of the Covid-19 pandemic, and also because the apartment we found was an older building that got renovated. That was right around 30% of the BF income at the time.

By October 2020, our financial situation improved when I finally got a job in the city! So with the dual incomes, we are able to use 65% of the BF’s income for necessities, 35% of his income for savings and investments, 20% of mine goes to necessities, 10% goes into miscellaneous, and 70% goes to savings.

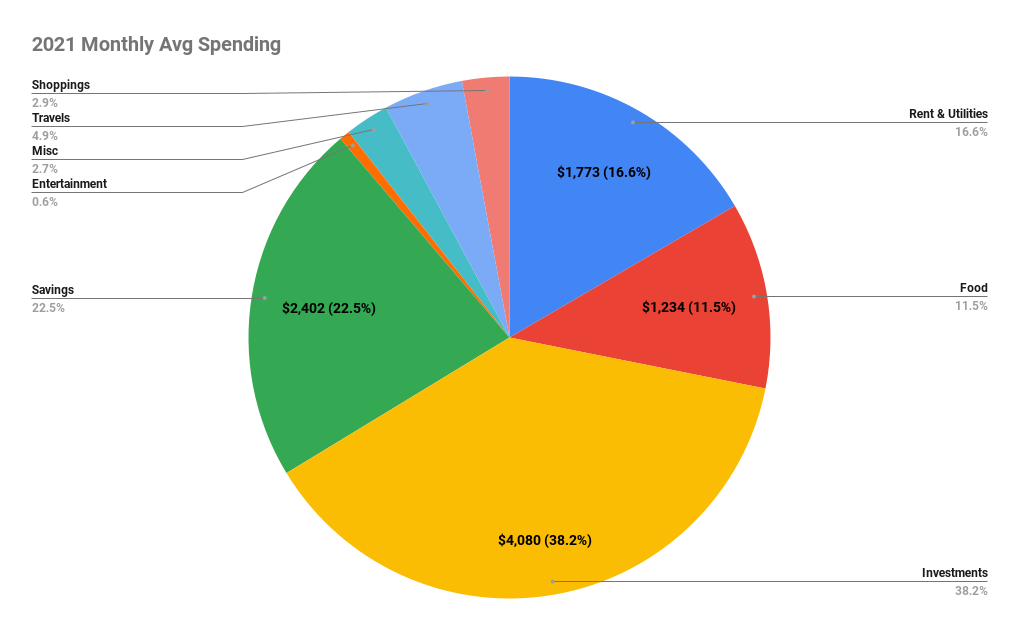

That at least was the plan anyway 🙂 Here is a chart of our average spending per month in 2021!

Overall, we were able to put away 60% of our combined income each month into savings and investments. Health insurances are deducted from our paychecks, so they are not included in the monthly budget; it’s not something we need to think about month-to-month.

We chose food and eating out to be our splurging category (~10%), and shopping, travels, and car maintenance would go under the miscellaneous category ( ~10% ).

Since we do live far away from our families, we tend to travel back quite often via car, amtrak, and sometimes via planes for emergencies. We also use points from our travel credit cards for some of our trips!

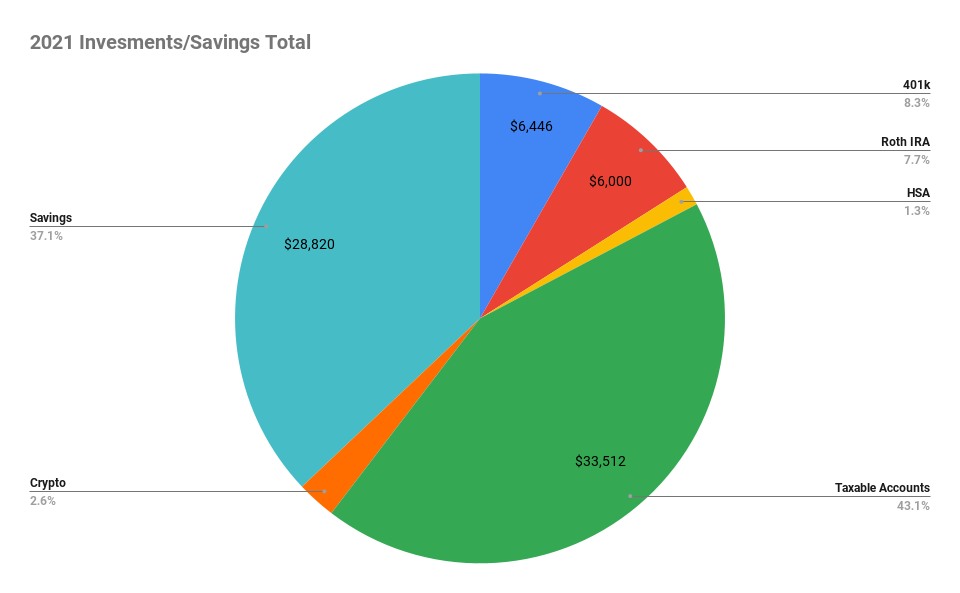

After 1 full year of both of us having a full-time job. In 2021, we saved a grand total of $77,778 in savings and investments. $41,946 for me and $35,832 for him. We are excluding the numbers from the second half of 2020 for this clean chart 🙂

Overall, we are very happy with our savings so far and we look forward to 2022 to see our money continue to grow and be another step closer to FIRE.

This design is steller! You definitely know how to keep a reader entertained.

Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Wonderful job.

I really loved what you had to say, and more than that, how you presented it.

Too cool!

TSI