Hi there! We’ve created this blog to document our FIRE journey, and investing is a major part of how we’ll be able to get there. So, I figured that it’d be good to show the GF’s and my investment portfolios. Given that Q1 2022 just finished, it’s a good time to start doing the portfolios summary kind of post 🙂

This is gonna be a monthly post (and maybe quarterly as well) that will give an update on our portfolios, how much dividends we’ve added to our portfolio, and of course, how much dividends we’ve received!

In summary, I have a taxable and a Roth IRA account, and the GF has her taxable account. The combined market value is currently at $55,978.15, and our cost basis is $54,388.12. Note that the cost basis is somewhat inaccurate because I did rebalance my portfolio to be more dividend growth focused, and the gains from that are counted as part of the cost basis.

Portfolios Summary

Currently, there are 24 holdings in our portfolios. Most of these positions are blue chips dividend-paying companies (along with some growth stocks) that have a long history of paying out dividends as well as increasing their dividends year-over-year. With that said, I will be selling some of our positions in April (will provide details in the April summary), taking those gains, and putting them into some of our stronger convictions.

The positions I’m selling out of are either companies that have a lower growth rate or are simply growth companies that have rallied recently and provided some nice gains. That’s not to say that these companies are bad, but I think that I can put the money elsewhere that will provide me with better dividend growth. This should consolidate the portfolios down to around 20-21 holdings.

Roth IRA

| Ticker | Sector | Total Shares | Market Value | Unrealized Gains (%) | Yield (%) | Annual Dividend | Market Allocation | Dividend Allocation |

|---|---|---|---|---|---|---|---|---|

| AAPL | Information Technology | 11.00478 | $1,918.24 | 70.46% | 0.50% | $9.68 | 9.85% | 1.97% |

| ALLY | Financials | 27.56371 | $1,212.25 | -9.22% | 2.73% | $33.08 | 6.23% | 6.74% |

| AVGO | Information Technology | 2.15582 | $1,351.66 | -3.95% | 2.62% | $35.36 | 6.94% | 7.20% |

| BLK | Financials | 1.38876 | $1,069.01 | 8.28% | 2.54% | $27.11 | 5.49% | 5.52% |

| COST | Consumer Staples | 2.3542 | $1,355.01 | 4.61% | 0.55% | $7.44 | 6.96% | 1.51% |

| JNJ | Healthcare | 2.77825 | $495.06 | 5.24% | 2.38% | $11.78 | 2.54% | 2.40% |

| KO | Consumer Staples | 7.60652 | $478.22 | 7.58% | 2.80% | $13.39 | 2.46% | 2.73% |

| LOW | Consumer Discretionary | 4.10688 | $831.23 | -19.66% | 1.58% | $13.14 | 4.27% | 2.68% |

| MMM | Industrials | 2.72704 | $408.21 | -14.89% | 3.98% | $16.25 | 2.10% | 3.31% |

| MSFT | Information Technology | 5.67482 | $1,755.90 | 67.22% | 0.80% | $14.07 | 9.02% | 2.86% |

| SBUX | Consumer Discretionary | 22.46494 | $2,055.32 | -10.91% | 2.14% | $44.03 | 10.56% | 8.96% |

| SCHD | ETF | 20.06125 | $1,589.45 | -0.71% | 3.13% | $49.75 | 8.17% | 10.13% |

| STOR | Real Estate | 54.22382 | $1,603.40 | -8.04% | 5.21% | $83.50 | 8.24% | 17.00% |

| TROW | Financials | 5.31918 | $813.09 | 8.17% | 3.14% | $25.53 | 4.18% | 5.20% |

| TRV | Financials | 2.86195 | $530.18 | 18.65% | 1.90% | $10.07 | 2.72% | 2.05% |

| TXN | Information Technology | 0.58592 | $106.68 | 1.92% | 2.53% | $2.70 | 0.55% | 0.55% |

| VICI | Real Estate | 65.47181 | $1,893.44 | -0.63% | 4.98% | $94.28 | 9.73% | 19.20% |

| Total | $19,466.35 | 11.03% | 2.52% | $491.16 | 100.00% | 100.00% |

My Taxable

| Ticker | Sector | Total Shares | Market Value | Unrealized Gains (%) | Yield (%) | Annual Dividend | Market Allocation | Dividend Allocation |

|---|---|---|---|---|---|---|---|---|

| AAPL | Information Technology | 7 | $1,220.17 | 8.58% | 0.50% | $6.16 | 7.27% | 1.17% |

| ALLY | Financials | 21.82 | $959.64 | -6.16% | 2.73% | $26.18 | 5.72% | 4.96% |

| AVGO | Information Technology | 2.012 | $1,261.48 | 12.18% | 0.03% | $0.33 | 7.51% | 0.06% |

| BLK | Financials | 2.166 | $1,667.30 | 9.03% | 2.54% | $42.28 | 9.93% | 8.01% |

| JNJ | Healthcare | 5 | $890.95 | 11.91% | 2.38% | $21.20 | 5.31% | 4.02% |

| KO | Consumer Staples | 25.182 | $1,583.19 | 15.49% | 2.80% | $44.32 | 9.43% | 8.40% |

| LOW | Consumer Discretionary | 5 | $1,012.00 | -19.31% | 1.58% | $16.00 | 6.03% | 3.03% |

| MMM | Industrials | 7 | $1,047.83 | -16.31% | 3.98% | $41.72 | 6.24% | 7.91% |

| QYLD | ETF | 40 | $840.40 | -7.61% | 11.99% | $100.80 | 5.01% | 19.11% |

| SBUX | Consumer Discretionary | 11.11 | $1,016.45 | -9.79% | 2.14% | $21.78 | 6.05% | 4.13% |

| SCHD | ETF | 22 | $1,743.06 | -2.07% | 3.13% | $54.56 | 10.38% | 10.34% |

| STOR | Real Estate | 63.027 | $1,863.71 | -4.95% | 5.21% | $97.06 | 11.10% | 18.40% |

| TRV | Financials | 5.028 | $931.44 | 16.87% | 1.90% | $17.70 | 5.55% | 3.36% |

| VICI | Real Estate | 26 | $751.92 | 4.36% | 4.98% | $37.44 | 4.48% | 7.10% |

| Total | $16,789.54 | 1.39% | 3.14% | $527.53 | 100.00% | 100.00% |

GF Taxable

| Ticker | Sector | Total Shares | Market Value | Unrealized Gains (%) | Yield (%) | Annual Dividend | Market Allocation | Dividend Allocation |

|---|---|---|---|---|---|---|---|---|

| AAPL | Information Technology | 7.44037 | $1,296.93 | 12.68% | 0.51% | $6.55 | 6.58% | 1.99% |

| ALLY | Financials | 18.42111 | $810.16 | -3.86% | 2.73% | $22.11 | 4.11% | 6.72% |

| AMD | Information Technology | 3.42368 | 370.41 | 20.62% | 0.00% | $- | 1.88% | 0.00% |

| AMZN | Consumer Discretionary | 0.37117 | $1,214.17 | -6.41% | 0.00% | $- | 6.16% | 0.00% |

| AVGO | Information Technology | 0.87766 | $550.28 | -3.42% | 2.62% | $14.39 | 2.79% | 4.38% |

| BLK | Financials | 1.13895 | $876.72 | 9.59% | 2.54% | $22.23 | 4.45% | 6.76% |

| COST | Consumer Staples | 0.97736 | $562.54 | 3.41% | 0.55% | $3.09 | 2.85% | 0.94% |

| CRWD | Consumer Discretionary | 4.39404 | $1,001.18 | -8.98% | 0.00% | $- | 5.08% | 0.00% |

| GOOGL | Communication Services | 0.60087 | $1,684.24 | 1.70% | 0.00% | $- | 8.54% | 0.00% |

| JNJ | Healthcare | 2.18835 | $389.94 | 3.96% | 2.38% | $9.28 | 1.98% | 2.82% |

| KO | Consumer Staples | 5.97067 | $375.38 | 5.67% | 2.80% | $10.51 | 1.90% | 3.20% |

| LOW | Consumer Discretionary | 2.11839 | $428.76 | -19.08% | 1.58% | $6.78 | 2.17% | 2.06% |

| MMM | Industrials | 1.76256 | $263.84 | -16.25% | 3.98% | $10.50 | 1.34% | 3.19% |

| MSFT | Information Technology | 5.21292 | $1,612.98 | -1.31% | 0.80% | $12.93 | 8.18% | 3.93% |

| NVDA | Information Technology | 2.62934 | $702.35 | 40.41% | 0.06% | $0.42 | 3.56% | 0.13% |

| SBUX | Consumer Discretionary | 17.21998 | $1,575.46 | -1.18% | 2.14% | $33.75 | 7.99% | 10.26% |

| SCHD | ETF | 15.54515 | $1,231.64 | -1.73% | 3.13% | $38.55 | 6.24% | 11.72% |

| STOR | Real Estate | 35.83817 | $1,059.73 | -6.14% | 5.21% | $55.19 | 5.37% | 16.78% |

| TROW | Financials | 7.2867 | $1,113.84 | 9.21% | 3.14% | $34.98 | 5.65% | 10.64% |

| TRV | Financials | 2.15282 | $398.81 | 16.31% | 1.90% | $7.58 | 2.02% | 2.30% |

| TSLA | Consumer Discretionary | 1.1982 | $1,299.56 | 42.35% | 0.00% | $- | 6.59% | 0.00% |

| TXN | Information Technology | 1.11212 | $202.49 | 0.27% | 2.53% | $5.12 | 1.03% | 1.56% |

| VICI | Real Estate | 24.23329 | $700.83 | 0.34% | 4.98% | $34.90 | 3.55% | 10.61% |

| Total | $19,722.24 | 4.79% | 1.67% | $328.86 | 100% | 100% |

Dividends

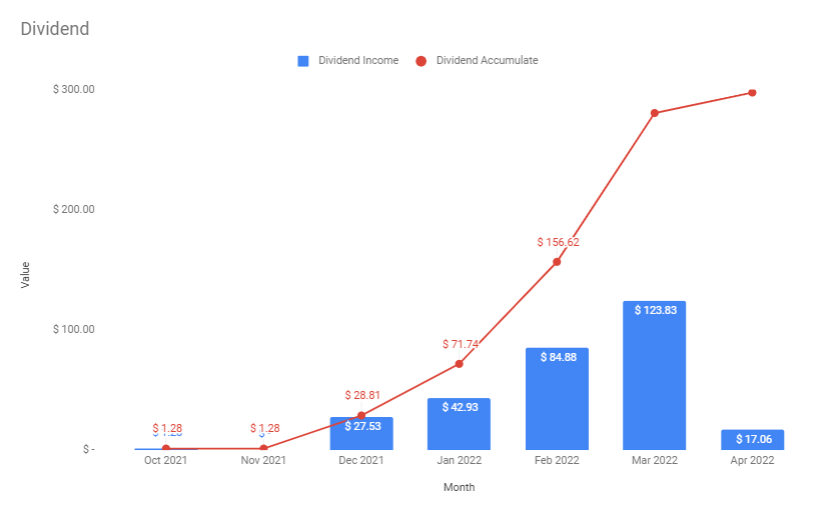

Since we started focusing more on building our passive income through dividend growth strategy, our dividend has been growing consistently. Starting from Dec 2021, we’ve received a total of $280.45 in dividends. For Q1 2022, we received $251.64 ($42.93 in Jan, $84.88 in Feb, and $123.83 in Mar).

Our expected annual dividend currently is $1,380.21, or $115.02 per month, with an expected annual growth rate of 12.20% (weighted average of growth rate). This means that our dividends will continue to snowball as we put more money into the market along with the 12.2% growth rate! And this, we hope, will eventually grow into a big enough source of truly passive income and fund parts of our living expenses.