Hi there! It’s been quite a while since our last post (we’ve been busy with work and travel and being lazy), but we’re back! And we think that it’s a good time to do a portfolios update post since Q2 2022 just ended. We’ll go over where our portfolios are currently at and what we’ve bought/sold as well as how much dividends we’ve received, so you all can come along for the ride.

In summary, our combined market value is currently at $61,049.55 (as of 7/10/2022), and our cost basis is $69,526.30. This is spread across my taxable account, Roth IRA, and the GF’s taxable account.

The market has been tanking left and right, be it tech stocks or dividend payers. However, we are not concerned about it because we’re not looking to make quick gains. Instead, we’re trying to increase our passive income steadily through dividends for the next who-knows-how-many-years. If anything, we’re actually excited about buying more of these companies when they’re currently selling off!

Portfolios Summary

Currently, there are 21 holdings in our portfolios. Most of these positions are blue chips dividend-paying companies (along with some growth stocks) that have a long history of paying out dividends as well as increasing their dividends year-over-year.

We’ve trimmed down some of our positions back in Q1 and invested the proceeds into our stronger convictions. This was detailed in our April portfolio update post, so feel free to check it out! But to recap, we’ve sold most of our tech companies that are usually considered higher growth and more volatile (e.g. AMD, NVDA, etc.), and we’ve invested the money into other companies that have more consistent growth along with reliable dividend increase (e.g. SBUX, TROW, BLK, TXN, etc.)

Roth IRA

| Ticker | Sector | Total Shares | Market Value | Unrealized Gains (%) | Yield (%) | Annual Dividend | Market Allocation | Dividend Allocation |

|---|---|---|---|---|---|---|---|---|

| AAPL | Information Technology | 11.0048 | $1,618.14 | -12.50% | 0.63% | $10.12 | 8.96% | 1.90% |

| ALLY | Financials | 29.55388 | $1,026.70 | -23.11% | 3.45% | $35.46 | 5.68% | 6.65% |

| AVGO | Information Technology | 2.1558 | $1,075.09 | -23.61% | 3.29% | $35.36 | 5.95% | 6.63% |

| BLK | Financials | 1.8134 | $1,123.53 | -14.00% | 3.15% | $35.40 | 6.22% | 6.64% |

| COST | Consumer Staples | 2.3542 | $1,180.73 | -8.84% | 0.72% | $8.48 | 6.53% | 1.59% |

| HD | Consumer Discretionary | 2.2458 | $643.34 | -5.69% | 2.65% | $17.07 | 3.56% | 3.20% |

| LOW | Consumer Discretionary | 4.10686 | $745.93 | -27.90% | 2.31% | $17.25 | 4.13% | 3.24% |

| MMM | Industrials | 2.727 | $351.02 | -26.81% | 4.63% | $16.25 | 1.94% | 3.05% |

| MSFT | Information Technology | 5.6748 | $1,518.92 | -17.74% | 0.93% | $14.07 | 8.41% | 2.64% |

| SBUX | Consumer Discretionary | 30.14049 | $2,389.53 | -17.80% | 2.47% | $59.08 | 13.23% | 11.08% |

| SCHD | ETF | 20.06121 | $1,454.44 | -9.15% | 3.89% | $56.57 | 8.05% | 10.61% |

| STOR | Real Estate | 54.22387 | $1,456.45 | -16.47% | 5.73% | $83.50 | 8.06% | 15.66% |

| TROW | Financials | 5.47144 | $634.47 | -15.74% | 4.14% | $26.26 | 3.51% | 4.92% |

| TXN | Information Technology | 4.968780842 | $772.80 | -14.29% | 2.96% | $22.86 | 4.28% | 4.29% |

| VICI | Real Estate | 66.32059 | $2,077.16 | 9.01% | 4.60% | $95.50 | 11.50% | 17.91% |

| Total | $18,068.25 | -14.16% | 2.95% | $533.23 |

My Taxable

| Ticker | Sector | Total Shares | Market Value | Unrealized Gains (%) | Yield (%) | Annual Dividend | Market Allocation | Dividend Allocation |

|---|---|---|---|---|---|---|---|---|

| AAPL | Information Technology | 7.5 | $1,102.80 | -7.50% | 0.63% | $6.90 | 4.82% | 0.84% |

| ALLY | Financials | 31.82 | $1,105.43 | -20.62% | 3.45% | $38.18 | 4.84% | 4.67% |

| AVGO | Information Technology | 2.012 | $1,003.36 | -10.77% | 3.29% | $33.00 | 4.39% | 4.04% |

| BLK | Financials | 3.489 | $2,161.64 | -6.12% | 3.15% | $68.11 | 9.46% | 8.34% |

| HD | Consumer Discretionary | 3.953 | $1,132.42 | -5.63% | 2.65% | $30.04 | 4.95% | 3.68% |

| LOW | Consumer Discretionary | 8.461 | $1,536.77 | -16.31% | 2.31% | $35.54 | 6.72% | 4.35% |

| MMM | Industrials | 7 | $901.04 | -28.03% | 4.63% | $41.72 | 3.94% | 5.11% |

| QYLD | ETF | 40 | $710.80 | -21.86% | 13.84% | $98.40 | 3.11% | 12.05% |

| SBUX | Consumer Discretionary | 26.05 | $2,065.24 | -8.73% | 2.47% | $51.06 | 9.03% | 6.25% |

| SCHD | ETF | 22 | $1,595.00 | -10.39% | 3.89% | $62.04 | 6.98% | 7.59% |

| STOR | Real Estate | 63.846 | $1,714.90 | -12.54% | 5.73% | $98.32 | 7.50% | 12.04% |

| TROW | Financials | 17.341 | $2,010.86 | -2.12% | 4.14% | $83.24 | 8.80% | 10.19% |

| TSM | Information Technology | 34.807 | $2,837.12 | -10.19% | 2.42% | $68.68 | 12.41% | 8.41% |

| TXN | Information Technology | 13.863 | $2,156.11 | -13.68% | 2.96% | $63.77 | 9.43% | 7.81% |

| VICI | Real Estate | 26.341 | $825.00 | 14.50% | 4.60% | $37.93 | 3.61% | 4.64% |

| Total | $22,858.50 | -10.87% | 3.57% | $816.93 |

GF Taxable

| Ticker | Sector | Total Shares | Market Value | Unrealized Gains (%) | Yield (%) | Annual Dividend | Market Allocation | Dividend Allocation |

|---|---|---|---|---|---|---|---|---|

| AAPL | Information Technology | 8.1482 | $1,198.11 | -4.23% | 0.63% | $7.50 | 5.95% | 1.68% |

| ALLY | Financials | 20.74751 | $720.77 | -21.03% | 3.45% | $24.90 | 3.58% | 5.57% |

| AMZN | Consumer Discretionary | 9.2098 | $1,064.10 | -28.93% | 0.00% | $0.00 | 5.29% | 0.00% |

| AVGO | Information Technology | 1.56637 | $781.15 | -12.31% | 3.29% | $25.69 | 3.88% | 5.75% |

| BLK | Financials | 1.76029 | $1,090.62 | -12.21% | 3.15% | $34.36 | 5.42% | 7.68% |

| COST | Consumer Staples | 0.9774 | $490.19 | -9.89% | 0.72% | $3.52 | 2.44% | 0.79% |

| CRWD | Consumer Discretionary | 4.394 | $836.54 | -23.95% | 0.00% | $0.00 | 4.16% | 0.00% |

| GOOGL | Communication Services | 0.6009 | $1,434.32 | -13.39% | 0.00% | $0.00 | 7.13% | 0.00% |

| HD | Consumer Discretionary | 3.7673 | $1,079.20 | -5.22% | 2.65% | $28.63 | 5.36% | 6.40% |

| LOW | Consumer Discretionary | 2.1184 | $384.76 | -27.38% | 2.31% | $8.90 | 1.91% | 1.99% |

| MMM | Industrials | 1.7626 | $226.88 | -27.98% | 4.63% | $10.50 | 1.13% | 2.35% |

| MSFT | Information Technology | 7.32939 | $1,961.79 | -10.19% | 0.93% | $18.18 | 9.75% | 4.07% |

| SBUX | Consumer Discretionary | 34.8296 | $2,761.29 | -4.26% | 2.47% | $68.27 | 13.72% | 15.27% |

| SCHD | ETF | 15.5452 | $1,127.02 | -10.08% | 3.89% | $43.84 | 5.60% | 9.80% |

| STOR | Real Estate | 35.8382 | $962.61 | -14.74% | 5.73% | $55.19 | 4.78% | 12.34% |

| TROW | Financials | 9.71825 | $1,126.92 | -14.62% | 4.14% | $46.65 | 5.60% | 10.43% |

| TSLA | Consumer Discretionary | 1.1982 | $901.39 | -1.26% | 0.00% | $0.00 | 4.48% | 0.00% |

| TXN | Information Technology | 7.75316 | $1,205.85 | -12.19% | 2.96% | $35.66 | 5.99% | 7.97% |

| VICI | Real Estate | 24.56148 | $769.27 | 10.14% | 4.60% | $35.37 | 3.82% | 7.91% |

| Total | $20,122.78 | -11.87% | 2.22% | $447.16 |

Dividends

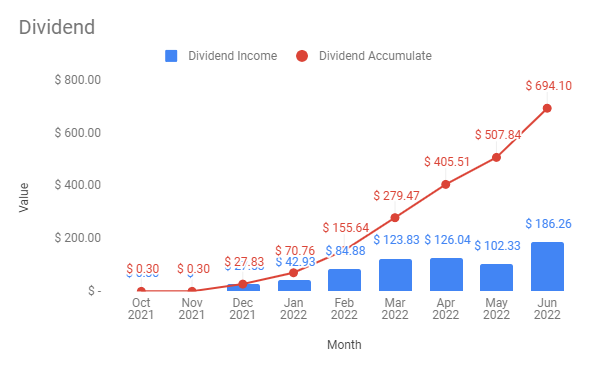

For Q2 2022, we’ve received $414.63 in dividends ($126.04 in April, $102.33 in May, and $186.26 in Jun)! This is a 64.77% increase from Q1 2022, which was $251.64. It’s important to note that the reason why Q1 number is low was that the majority of the stocks were bought after the ex-dividend dates, so it took some time for the dividends to kick in.

Our expected annual dividend currently is $1,797.31, or around $149.78 per month, with an expected annual growth rate of 14.28%. This is good progress, considering that our projected annual dividend was $1,380.21 back in Q1 2022. And as always, this number will continue to snowball as we put more money into the market, even if the market falls (more sales!)