Hi there! It’s time again for our quarterly portfolios and dividend update! So far, 2022 has been a roller coaster that never really goes back up, which is good for those of us who are still in the accumulation phase.

The S&P 500 is currently down 20% for the year, the biggest drop since the 2008 Financial Crisis’ -38%. However, it is during times like these that will provide the biggest opportunities to invest….most likely 🙂

With that said, we’ll go over where our portfolios are currently at and what we’ve bought/sold as well as how much dividends we’ve received, so stick around if you want to look at the numbers.

Portfolios Summary

In summary, our combined market value is currently at $66,031.24 (as of 10/7/2022), and our cost basis is $76,874.31. This is spread across my taxable account, Roth IRA, and the GF’s taxable account.

Currently, there are 18 holdings in our portfolios. Most of these positions are blue-chip dividend-paying companies (along with some growth stocks) that have a long history of paying out dividends as well as increasing their dividends year-over-year.

We’ve trimmed down some of our positions back in Q2 and invested the proceeds into the rest of our portfolios. We went from 21 holdings in Q2 to 18 holdings in Q3. The positions that we sold are QYLD, STOR, and TSLA.

What we sold!

Global X NASDAQ 100 Covered Call ETF (QYLD)

QYLD is a monthly covered-call ETF that we bought at the beginning of 2022. We bought this because it had a very high dividend yield (maybe too high) and paid monthly.

However, as we learned more about investing in high-quality companies and not focusing too much on the high yield, we took our loss and invested the money back into our other holdings. Our cost basis was $909.60, and we sold for $672.38 (-26%).

Tesla Inc (TSLA)

We sold out of TSLA because it has an extremely high valuation as well as the unpredictability of its CEO. Instead of relying on the high expectations that are priced in for TSLA, we put the money somewhere less risky and more consistent. Our cost basis was $919.91, and we sold for $969.25 (+6%).

Store Capital Corp (STOR)

STOR (Store Capitals) is a real estate investment trust (REIT) with tenants in the services, retail, and manufacturing industries. It is also a triple net lease REIT, which means the tenants are responsible for paying property taxes, insurance, and maintenance costs along with rent.

We bought into this company towards the end of 2021 and dollar cost averaged into it throughout 2022. But STOR announced that GIC and Oak Street will buy the company for $14B, and it will go private. The acquisition is expected to close in 2023, and it will pay shareholders $32.25/share if the transaction is successful.

We sold STOR instead of waiting for the acquisition to come through and reinvested the money while many companies are at an all-time low. Our cost basis was $4,869.09, and we sold for $4,912.26 (+.88%).

What we bought!

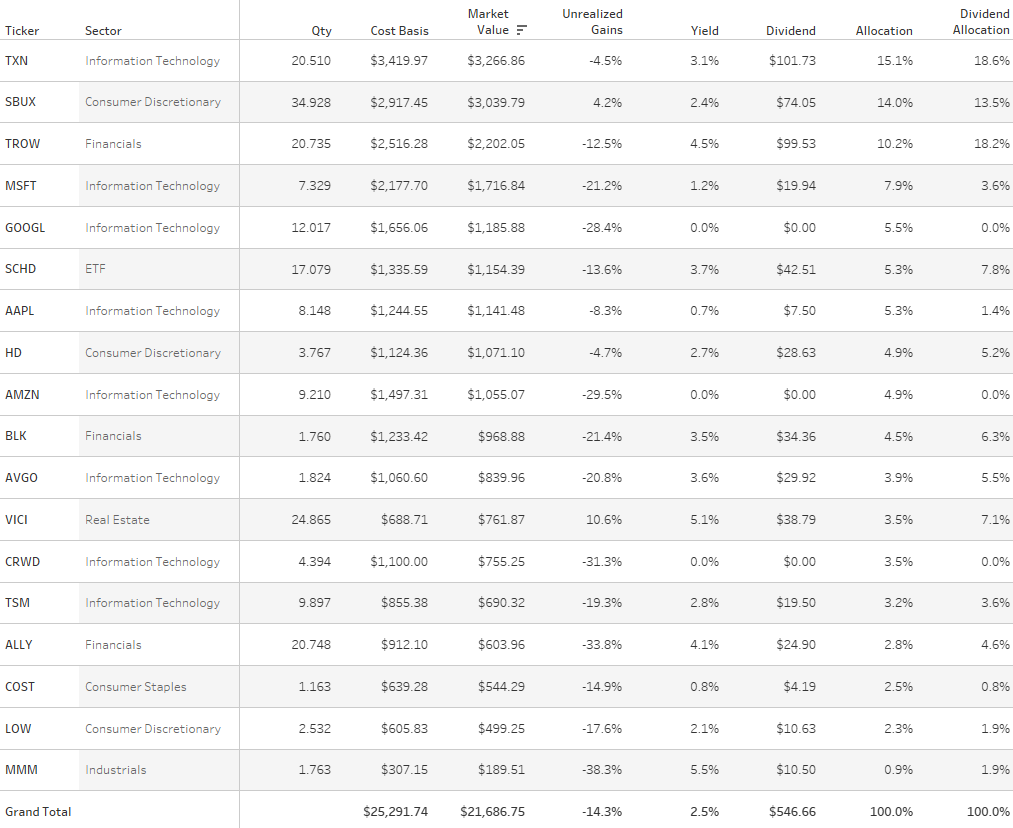

We reinvested the proceeds into LOW, SCHD, COST, ALLY, AVGO, BLK, TXN, TSM, and TROW. These are some positions that are currently in the red, which provide great sales for us.

In fact, the majority of our money went into BLK, TXN, TSM, and TROW because they are high-quality companies with great competitive advantages. They also have great track records with earnings growth and dividend growth, and we feel comfortable as we continue to invest in them despite the current market condition.

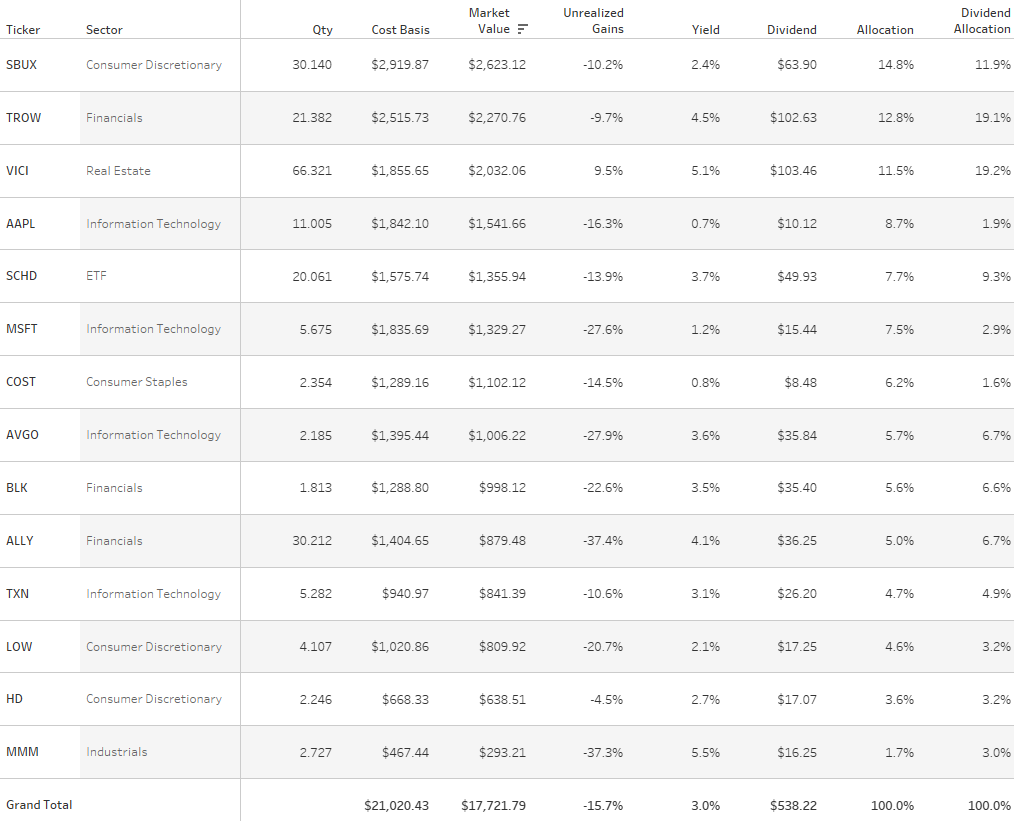

Roth IRA

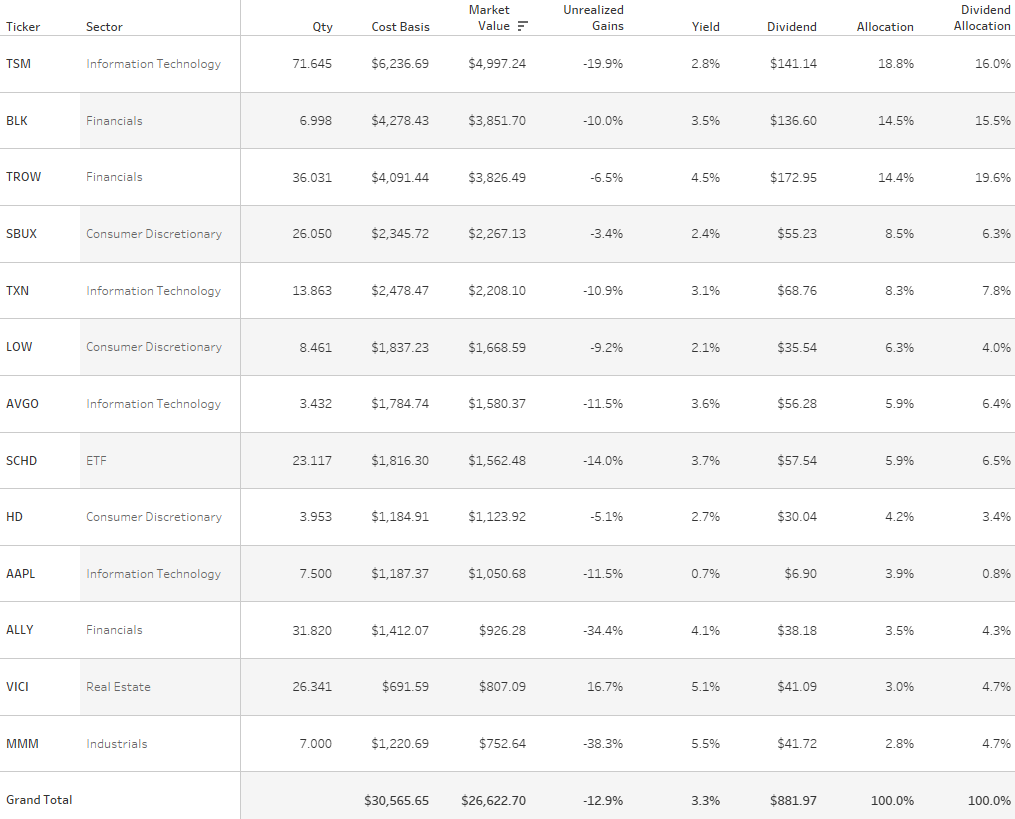

My Taxable

GF Taxable

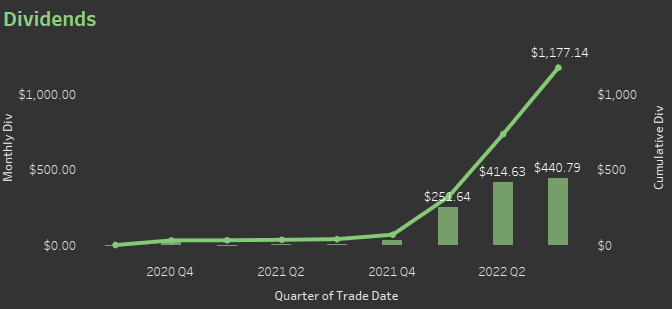

Dividends

For Q3 2022, we’ve received $440.79 in dividends ($121.72 in July, $132.05 in August, and $187.02 in September)! This is a 6.3% increase from Q2 2022’s $414.63.

As I was switching jobs back in July, I invested much less than normal, which results in only a slight increase, but an increase is an increase 🙂 I should be able to invest more consistently as I get paid from my new job.

Our expected annual dividend currently is $1,966.86, or around $163.90 per month, a 9.4% increase from the start of Q2 2022. As we continue to invest consistently, this number will one day allow us to FIRE and retire early if we so choose 🙂