Background

Taiwan Semiconductor (TSMC) is a Taiwanese semiconductor manufacturing company, and it is currently the largest semiconductor manufacturer w/ a market cap of $458 billion.

Founded in 1987 by Morris Chang, this company paved its way to becoming one of the most valuable companies in the world and arguably one of the most important companies when it comes to our technology-dependent world.

TSMC is a pureplay semiconductor foundry, which means that it is dedicated entirely to manufacturing chips rather than designing them. This is the opposite of one of the more popular fabless semiconductor companies like Nvidia, AMD, Apple, etc.

Fabless is another way to say that these companies only focus on the designing part of the process and will outsource the production of the chip. In fact, most of these fabless companies are customers of TSMC and rely on TSMC to manufacture their chips.

Strengths

Being a pure-play foundry, TSMC can focus its resources solely on the manufacturing of the chips as well as R&D in order to meet demands while keeping ahead of its competitors. For example, TSMC announced back in Jan 2022 a capital spending of around $40-44B USD to invest in new fabs. This is an increase from its $30B USD capital expenditure from 2021.

For comparison, Intel is spending $25-28B USD in 2022 in an attempt to close the gap in the chip manufacturing game with its rivals, one of which is TSMC. However, due to it being far behind TSMC, Intel would still need to work much harder to catch up to TSMC.

Another advantage TSMC has over its competitors is its unique relationships with its customers. Some of TSMC’s biggest customers include Apple, Nvidia, AMD, etc. And these companies don’t have many options when it comes to manufacturing partners that can give them quality products while keeping their intellectual secrets at the same time.

For example, Apple cannot go to Samsung to manufacture their chips because they compete in the smartphone business. Likewise, Nvidia is unlikely to go to Intel because they compete in the data center market. This helped TSMC to build reliable partnerships with these companies that are hard to break down.

Risks

One of the biggest risks with TSMC is the geopolitical risk between the US, China, and Taiwan. Over the year, China has expressed its desire to unite Taiwan with China, and after Russia’s invasion of Ukraine, many questions if the same thing could happen with Taiwan.

As the biggest semiconductor manufacturer in the world with a market share of about 54%, you can say that the US and other nations could have a strong interest in supporting Taiwan and its semiconductor industry because of how dependent they are on TSMC, especially when talking about national defense systems.

China has been trying to end its reliance on chip-making by investing in its domestic manufacturing capacity. The US and Europe have also been pushing for more funding and financial incentives for the domestic semiconductor manufacturing market as risk management.

With that being said, I still think that TSMC could still come out ahead. Despite governments trying to build up their domestic semiconductor market, the downfall of Taiwan or TSMC would still be a heavy blow to the global chip supply chain.

Furthermore, a report by the Boston Consulting Group (BCG) stated that countries’ pursuit of self-sufficiency in the chip manufacturing market through national policies is not feasible as it could cost up to $400B USD in government incentives and more than $1T USD over ten years.

Along with this, TSMC still needs to be wary of competitors like Intel ramping up their investment and commitment to get back into the chip-making market. It is a serious threat to TSMC’s reign if Intel could improve its node technologies and successfully start mass production ahead of TSMC.

I still think TSMC is relatively safe from this as it is still doing large capital expenditures (much more than Intel) to keep its place. And again, it can focus its efforts and resources on what it is best known for, manufacturing, as opposed to being distracted by other businesses.

My Takes on TSMC

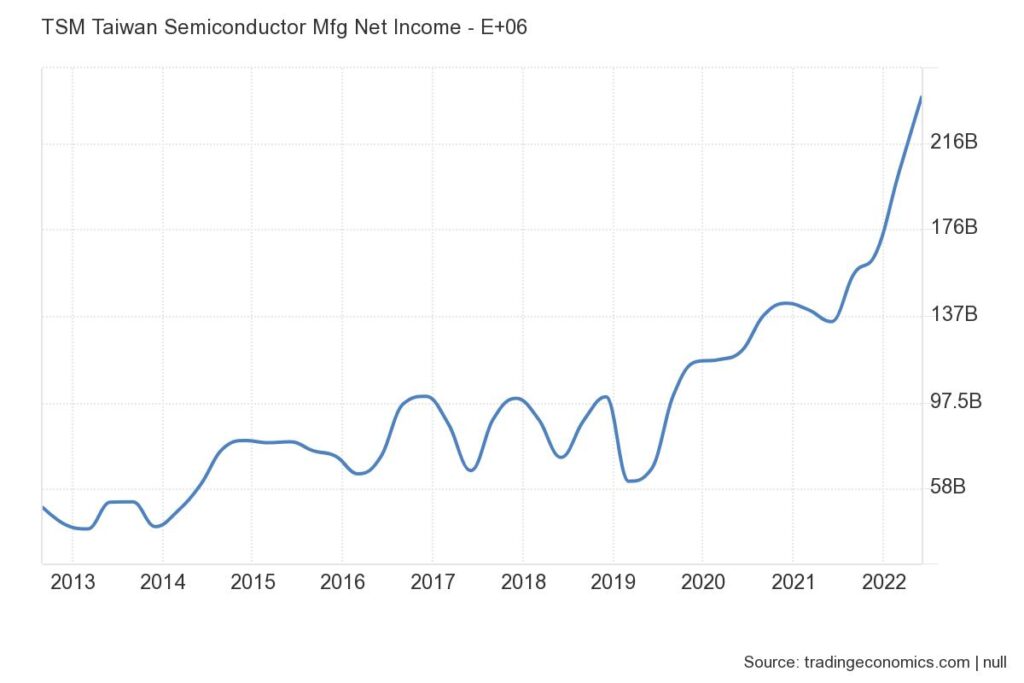

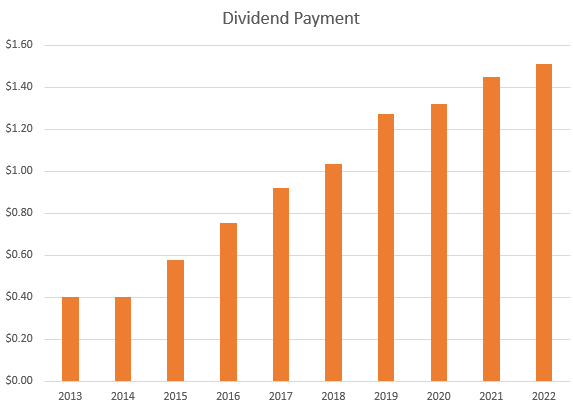

Despite the risks associated with TSMC, I think that it is still one of the best companies in the semiconductor industry to invest in. TSMC has been generating incredible profits year over year and increasing the dividend steadily as well.

It has a simple yet effective business model, focusing mainly on manufacturing semiconductors. It’s also in an industry with a high barrier to entry as manufacturing semiconductors requires an enormous amount of money as well as extensive knowledge and expertise.

As the world becomes more technologically advanced and demands grow, so will the dependence on TSMC and the more important it becomes.

Currently, TSMC is trading at a pe ratio of 17, which is 12% below the industry average. Not only that, it is 33% down year-to-date and 38% down from its all-time high, which makes it a very attractive investment *not financial advice*. I personally invest in TSMC, and I will continue to buy it as long as the price is right.